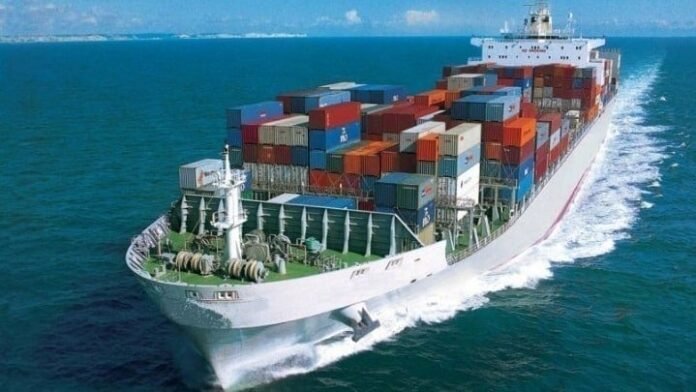

The shipping industry is highly exposed to geopolitical risk, as global trade routes, port access and maritime security are often disrupted by conflicts, sanctions, territorial disputes and policy shifts.

Now, with President Donald Trump back in the White House, professionals in the shipping industry are considering the threats and opportunities posed by an expected deluge of tariffs.

The Trump administration’s renewed emphasis on protectionist trade policies could reshape global supply chains, forcing shipping companies to adapt to shifting trade flows, evolving regulatory landscapes and potential retaliatory measures from key trading partners.

This is important for Greece, in particular, because shipping accounts for approximately 7.9 percent of the country’s GDP. Consequently, the giants of the Greek shipping world need to account for potential increased costs, supply chain delays and regulatory challenges.

Shifts in US economic policy

Imposing tariffs on imported goods has been a cornerstone of President Trump’s economic agenda since his first term. Since returning to the Oval Office, he has followed through on his campaign pledge to reinstate them—this time on an even larger scale.

Trump announced broad tariffs on imports from Mexico, Canada and China, but last-minute agreements delayed the levies on Mexico and Canada for 30 days. Meanwhile, on top of existing duties, a 10 percent tariff took effect on all Chinese imports starting February 4.

Trump has compared tariffs to a protective “ring around the US economy,” arguing they could help restore jobs in communities affected by globalization. He has also suggested expanding tariffs as a key revenue source for the federal government, shifting away from the income tax system that has dominated since the early 1900s. Recently, he stated his intention to establish an External Revenue Service to collect revenue from foreign sources.

Some critics of Trump’s economic policies argue that the costs of imposing tariffs on imported goods will be passed onto American consumers, making them poorer in the long run. Conversely, those in favour of tariffs contend that Trump’s policy will help redress trade deficits that put the American economy on the back foot.

Trump’s tariffs and the shipping industry

Trump’s recent imposition of tariffs has introduced a complex mix of challenges and opportunities for the shipping industry. On the one hand, these tariffs can disrupt established trade routes and supply chains, potentially leading to increased shipping costs and logistical complexities. On the other hand, such disruptions may create new shipping demands as companies seek alternative sourcing and markets, potentially benefiting certain shipping sectors.

One immediate consequence of the tariffs is the potential for increased shipping rates due to supply chain disruptions. As companies adjust their sourcing strategies to mitigate tariff impacts, shipping routes may become longer or less direct, leading to higher demand for shipping services and, consequently, increased rates. This scenario can be advantageous for shipping companies in the short term.

However, the long-term implications may be less favorable. The imposition of tariffs can lead to decreased trade volumes as the cost of goods increases, potentially reducing consumer demand. This decrease in demand can negatively impact the shipping industry, as there would be fewer goods to transport. Additionally, retaliatory tariffs from other countries could further suppress global trade volumes, compounding the challenges faced by the shipping sector.

Moreover, the uncertainty surrounding trade policies can lead to volatility in the shipping market. Companies may hesitate to enter into long-term shipping contracts, opting instead for short-term agreements that can adapt to changing trade dynamics. This volatility can make it difficult for shipping companies to plan and invest in their operations effectively.

While President Trump’s tariffs may offer some short-term benefits to the shipping industry through increased rates driven by supply chain disruptions, the long-term outlook is more uncertain. Decreased trade volumes, potential retaliatory measures and market volatility pose significant challenges that the industry must navigate carefully.

Impacts on Greek shipping

Greek shipping, which plays a crucial role in the country’s economy and the global maritime industry, is particularly sensitive to shifts in trade policies. The Greek-owned fleet leads globally with 4,992 ships and a total carrying capacity of 394.98 million dwt (deadweight tonnage), representing 16.9 percent of the world’s shipping. The industry is a key pillar of the Greek economy, contributing around seven percent of the country’s GDP and providing thousands of jobs.

Any disruption in global trade flows caused by tariffs could directly impact Greek shipping companies, particularly those involved in container shipping and bulk transport, as they rely on the steady movement of goods across international markets.

Additionally, Greek shipping’s strong presence in energy transportation could face indirect consequences if tariffs affect demand for oil and gas shipments. The US tariffs and potential retaliatory measures could disrupt energy supply chains, altering trade flows for key commodities such as crude oil and liquefied natural gas (LNG).

Given that Greek shipowners dominate the global tanker and LNG carrier markets, any reduction in energy trade between major economies could lead to volatility in shipping demand and freight rates. As a result, Greek shipping firms may need to adapt their strategies, seeking new markets or adjusting fleet utilization to remain resilient in an increasingly uncertain global trade environment.

Impacts on the wider Greek economy

Economists in Greece suggest that President Trump’s proposed tariffs on the European Union are unlikely to significantly impact the Greek economy, given its limited reliance on exports to the US.

Data from the first eleven months of 2024 indicates that Greek exports to the US accounted for approximately 4.8 percent of the nation’s total exports, equating to €2.2 billion. During the same period, imports from the US were valued at €2 billion, resulting in a trade surplus of €200 million.

Notably, the food and live animals sector exhibited the largest surplus at €521.6 million, while fossil fuels and lubricants recorded the most significant deficit at €399 million.

Beyond direct trade relations, potential indirect effects warrant consideration. Approximately 20 percent of the EU 27’s exports are destined for the US, and any increase in US tariffs on EU products could indirectly affect Greek exports, especially those integrated into European value chains. For instance, Greek intermediate goods used in the production of final products exported by other EU countries to the US might face challenges. The extent of these impacts will depend on the specific tariff increases and the sensitivity of Greek exports to such changes.

Yiannis Stournaras has indicated that Greece does not anticipate significant effects from the proposed US tariffs due to its limited exposure to US exports. However, he acknowledges potential indirect consequences stemming from broader impacts on the Eurozone’s economic growth.

Estimates suggest that if tariffs are imposed at a rate of ten percent, the Eurozone’s growth could decline by approximately 0.5 to 1 percentage point over a two-year horizon. While European inflation is not expected to be substantially affected, there could be general stagflationary trends in the global economy. For Greece, a slowdown in Eurozone growth could have a modest impact on its GDP, but significant effects are not anticipated.