METLEN, the global industrial and energy powerhouse, has officially begun trading its shares on the London Stock Exchange (LSE), marking a historic milestone for both the company and Greek entrepreneurship.

The move is not merely a change in venue but a strategic maneuver to cement the company’s position as a major international player and access a broader pool of global capital.

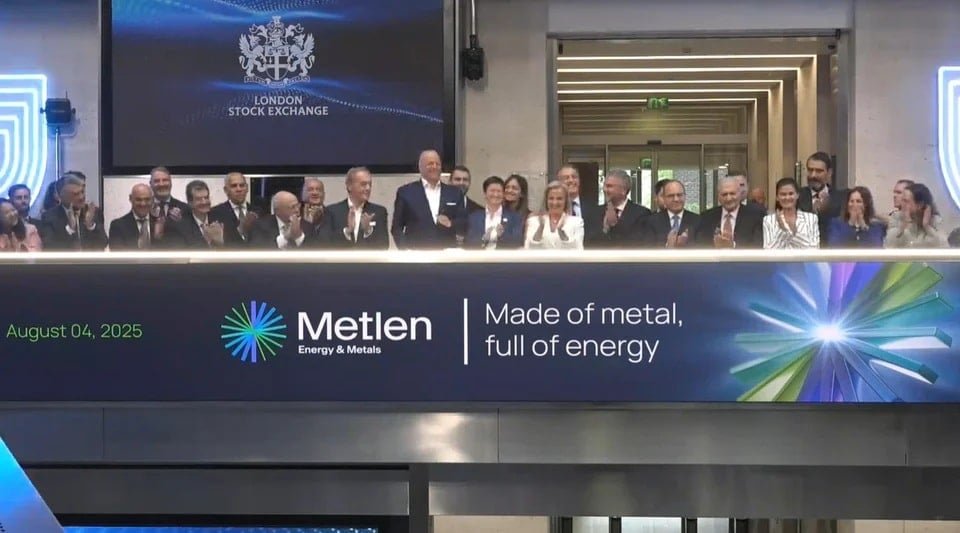

The listing ceremony took place in London, where Chairman and CEO Evangelos Mytilineos, alongside LSE executives, pressed the button to open the trading session, amidst applause and falling confetti.

Background on a Greek success story

METLEN, now operating under its new name, is the successor to the company formerly known as Mytilineos S.A. The business began as a family-owned metallurgy firm in 1908 and was formally established as the MYTILINEOS group in 1990 by Evangelos Mytilineos. Over the decades, it has grown from a local metallurgy business into a multinational leader in two core sectors: Energy and Metals.

Today, METLEN has a presence in over 40 countries and operations on five continents. It boasts a market capitalization of over €6 billion and employs thousands of people. The company has a diverse portfolio, which includes power generation from gas and renewables, metals production from its large-scale facilities in Greece, and extensive engineering, procurement, and construction (EPC) projects globally.

Significance of the LSE Listing for METLEN

The decision to list on the LSE is a culmination of a strategic review and a major step in the company’s evolution. As Evangelos Mytilineos stated, “This move is not symbolic but strategic. It is the beginning of a new era.” The key reasons for the move include:

Access to Deeper Capital: The LSE provides access to a much larger and more liquid market than the Athens Stock Exchange (ATHEX). This will allow METLEN to attract institutional investors from around the world, providing greater capital for future growth and expansion.

International Profile and Visibility: The LSE is a global financial hub. A primary listing there elevates METLEN’s international profile, signaling its status as a mature and robust global company and improving its brand recognition.

First LSE Listing in Euros: Notably, METLEN is the first company to be listed on the LSE with its shares trading in euros. This is a significant logistical and symbolic achievement, simplifying trading for many European investors and highlighting the company’s dual identity as a Greek-based, European-focused global entity.

Retention of Greek Ties: While the LSE will be its primary market, METLEN will maintain a secondary listing on the ATHEX. This ensures that the company remains accessible to its original shareholder base and reaffirms its commitment to its Greek roots and the local economy.

The listing was successfully completed through a voluntary share exchange offer, which saw an acceptance rate of over 90%, demonstrating strong shareholder confidence in the company’s new direction. This move marks a new chapter for METLEN, positioning it for continued growth and innovation on the global stage.

Related: The Billionaire Powerhouses Dominating the Athens Stock Exchange